What is the profit margin?

Profit margin is a measure of a company’s profitability. It is calculated by dividing the company’s net income by its revenue.

The resulting number, expressed as a percentage, shows the amount of each dollar of revenue that the company keeps as profit. For example, if a company has a profit margin of 10%, it means that it makes 10 cents in profit for every dollar of revenue. Profit margin is a useful tool for comparing the profitability of different companies in the same industry or for evaluating the performance of a single company over time.

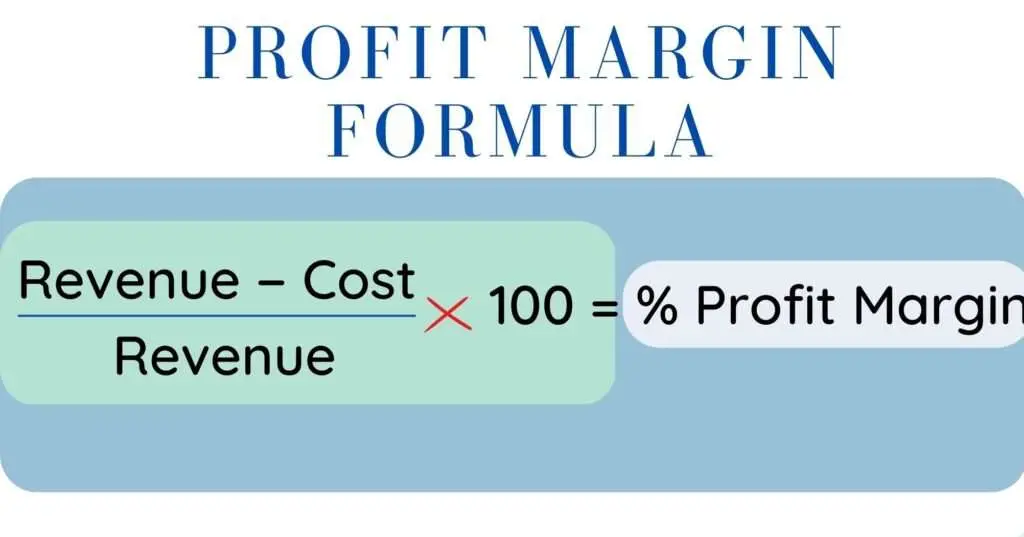

The formula for profit margin is as follows:

A 50% profit margin is achieved if you invest $1 to receive $2 in return. Creating a product for $100 and selling it for $150 results in a profit of $50 and a profit margin of 33%. A margin of 66 percent is achieved if you can sell the same product for $300. Bigger prices and reduced costs result in higher profit margins. In any event, your profit margin is limited to a maximum of 100%, which can only occur if you are able to sell an item that costs you nothing.

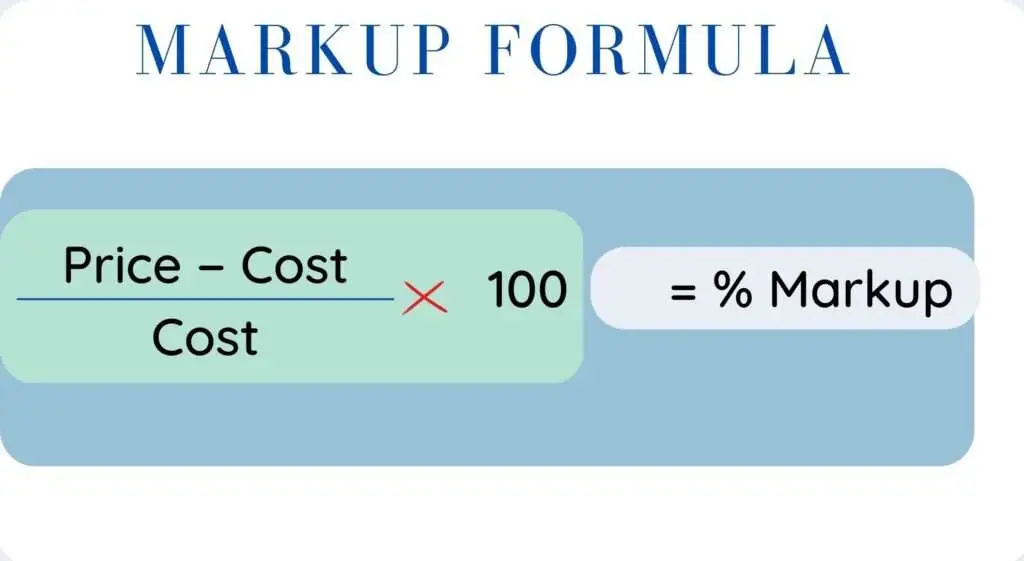

The term “markup,” which describes how the cost of an offer relates to its price, is not the same as profit margin. The markup formula is shown below.

If an offer costs $1 to manufacture and you sell it for $2, your markup is 100%, but your profit margin is only 50%. Depending on the pricing and the total cost of the offer, markups may range from 200 percent to 10,000 percent, whereas margins are always limited to a maximum of 100 percent. Your markup will be higher if your pricing is higher and your cost is lower.

It seems obvious that most firms strive to keep the profit margin of each offer as high as possible; the bigger the margin, the more money the company keeps from each sale. Nevertheless, a variety of market forces, including aggressive pricing by rivals, new offerings that reduce interest in existing ones, and rising input prices, might eventually result in a fall in margins.

Businesses frequently compare bids using profit margins. When a business has multiple offerings on the market, it usually chooses the ones with the biggest margins. When a company seeks to reduce expenses, it frequently starts by rejecting offers with the lowest margins.

Examine a company carefully, paying great attention to the profit margin. The business is stronger the bigger the margin.

What does gross profit margin tell you?

The gross profit margin tells you how much money your company makes after deducting its direct operating expenses, which can include labor, raw materials, and other direct manufacturing costs.

There are three main profitability ratios: operational profit margin, net profit margin, and this one. It may be argued that this is the most crucial of the three profitability indicators since, absent a sufficiently high gross profit margin, a company won’t be viable—at least not for very long.

Your company is in peril if you can’t increase your gross margin to the point where your sales exceed your manufacturing costs.

How do improve your gross profit margin?

There are several ways to improve your gross profit margin:

Increase your selling price. This is perhaps the most obvious way to improve your gross profit margin. By increasing the price of your product or service, you can increase the amount of money you make for each unit sold. However, it’s important to consider the potential impact on demand for your product before making this decision.

Reduce your cost of goods sold: Another way to improve your gross profit margin is to reduce the cost of the materials, labor, and other expenses that go into producing your product or service. This could involve negotiating better prices with suppliers, streamlining your production process to reduce waste, or finding more efficient ways to use resources.

Sell higher-margin products or services: If you offer a variety of products or services, consider focusing on those with higher margins. This could involve phasing out lower-margin offerings or investing in the development of new, higher-margin products or services.

Increase efficiency: Improving efficiency in your business can help reduce costs and improve your gross profit margin. This could involve automating certain processes, investing in better technology or equipment, or implementing lean manufacturing practices.

Improve pricing strategies: Reviewing and adjusting your pricing strategies can also help improve your gross profit margin. This could involve implementing dynamic pricing, bundling products or services, or offering promotions or discounts to drive sales.

How do I analyze the gross profit margin?

Gross profit margin is a company’s profits, calculated as revenue minus the cost of goods sold, divided by revenue, expressed as a percentage. To analyze gross profit margin, you can follow these steps:

- Calculate the gross profit by subtracting the cost of goods sold from the revenue.

- Calculate the gross profit margin by dividing the gross profit by the revenue and expressing it as a percentage.

- Compare the gross profit margin to industry benchmarks or the company’s historical gross profit margin to determine if it is performing better or worse than expected.

- Identify any trends in the gross profit margin over time. Is it increasing or decreasing? Why might this be happening?

- Consider the factors that may be impacting the gross profit margin, such as changes in the prices of raw materials, changes in demand for the company’s products or services, or changes in the company’s operating costs.

- Use the analysis of the gross profit margin to inform decisions about pricing, cost control, and other aspects of the company’s operations.

To analyze the gross profit margin, you can compare it to the margins of other companies in the same industry or to the company’s own margins in previous periods. A higher gross profit margin indicates that the company is able to generate more profit on the products it sells, while a lower gross profit margin may indicate that the company is struggling to control its costs

Also read: What is financial management?

Types of Profit Margin?

There are several types of profit margins that companies may use to measure their financial performance:

Gross profit margin

This is the percentage of revenue that a company retains after deducting the cost of goods sold. It represents the profit a company makes from its production and manufacturing activities.

Operating profit margin

This is the profit a company makes after deducting operating expenses such as salaries, rent, and utilities from its revenue. It reflects the efficiency of a company’s operations.

Net profit margin

This is the percentage of revenue that a company retains as profit after deducting all expenses, including taxes. It is a measure of a company’s overall profitability.

Return on investment (ROI)

This is a measure of the profitability of an investment or the efficiency of an investment. It is calculated by dividing the net profit by the cost of the investment.

Return on equity (ROE)

This is a measure of the profitability of a company in relation to the equity invested in it by shareholders. It is calculated by dividing the net profit by the shareholder equity.

Share on WhatsApp

WhatsApp

Share on facebook

Facebook

Share on twitter

Twitter

Share on LinkedIn

LinkedIn