Definition

A balance sheet is a financial statement that reports a company’s assets, liabilities, and equity at a specific point in time. The balance sheet provides a snapshot of a company’s financial position. It shows the resources that a company controls (its assets), the obligations it has to outsiders (its liabilities), and the residual interest in those assets that belongs to the company’s shareholders (its equity).

How balance sheet work and its component?

The balance sheet is divided into two sections: the assets section and the liabilities and equity section. The assets section lists the company’s resources, such as cash, investments, and property. The liabilities and equity section lists the company’s debts and the equity that the shareholders have in the company.

The balance sheet must be in balance, meaning that the total value of the assets must equal the sum of the liabilities and equity. This is why it is called a “balance” sheet. The balance sheet equation can be represented as follows:

Assets = Liabilities + Equity

The balance sheet is an important tool for investors and creditors to use when evaluating a company’s financial health. It helps them understand the company’s financial position and how it is financed. The balance sheet provides information about a company’s assets, liabilities, and equity that can be used to assess its financial strength and stability.

What are the types of balance sheets?

There are two main types of balance sheets: the classified balance sheet and the unclassified balance sheet.

Classified balance sheet

A classified balance sheet is a balance sheet that is organized into distinct categories or classifications, such as current assets, noncurrent assets, current liabilities, and noncurrent liabilities. This type of balance sheet provides more detailed and relevant information about a company’s financial position, as it allows users to easily see how the company’s assets and liabilities are structured.

Current assets

These are assets that are expected to be converted into cash or used up within one year or the company’s operating cycle, whichever is longer. Examples of current assets include cash, accounts receivable, and inventory.

Noncurrent assets

These are assets that are not expected to be converted into cash or used up within one year or the company’s operating cycle. Examples of noncurrent assets include property, plant, and equipment, and intangible assets such as patents and trademarks.

Current liabilities

These are obligations that are expected to be settled within one year or the company’s operating cycle, whichever is longer. Examples of current liabilities include accounts payable, short-term loans, and taxes payable.

Noncurrent liabilities

These are obligations that are not expected to be settled within one year or the company’s operating cycle. Examples of noncurrent liabilities include long-term debt, pensions, and leases.

Unclassified balance sheet

An unclassified balance sheet, also known as a simple balance sheet, is a balance sheet that does not have distinct classifications for assets and liabilities. It simply lists all of the assets and liabilities in one section each. This type of balance sheet is less detailed and provides less information about a company’s financial position compared to a classified balance sheet.

In addition to the classified and unclassified balance sheets, there are also a few other types of balance sheets that are used in specific situations:

Consolidated balance sheet

A consolidated balance sheet is a balance sheet that presents the financial position of a parent company and its subsidiaries as a single entity. It combines the assets, liabilities, and equity of the parent company and its subsidiaries into one balance sheet.

Comparative balance sheet

A comparative balance sheet is a balance sheet that presents financial information for two or more periods, such as for the current year and the previous year. It allows users to compare the company’s financial position at different points in time and see how it has changed.

Pro forma balance sheet

A pro forma balance sheet is a hypothetical balance sheet that presents what the company’s financial position would look like under certain assumptions or scenarios. It is used to project the company’s future financial position and to evaluate the impact of potential events or transactions.

Overall, the balance sheet is a crucial financial statement that provides important information about a company’s financial position and how it is financed. Understanding the different types of balance sheets and how they are used can help investors and creditors better evaluate a company’s financial health and make informed decisions.

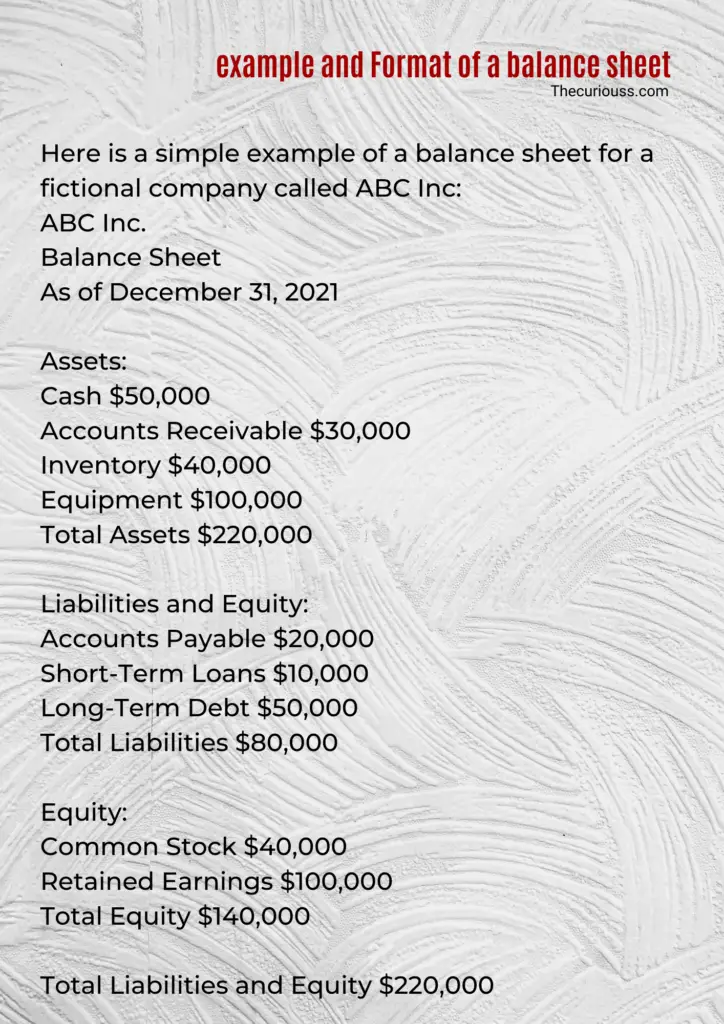

What is the balance sheet example and format?

This balance sheet shows that ABC Inc. has $220,000 in assets, including cash, accounts receivable, inventory, and equipment. It also shows that the company has $80,000 in liabilities, including accounts payable, short-term loans, and long-term debt. The equity section shows that the company has $40,000 in common stock and $100,000 in retained earnings, for a total of $140,000 in equity.

The balance sheet is in balance, as the total assets of $220,000 equal the sum of the liabilities ($80,000) and equity ($140,000). This balance sheet provides a snapshot of ABC Inc.’s financial position as of December 31, 2021 and shows the company’s assets, liabilities, and equity at that specific point in time.

What role does the balance sheet play?

The balance sheet is used by a variety of stakeholders, including investors, creditors, and managers, to evaluate a company’s financial health and make informed decisions. Here are some of the key reasons why the balance sheet is important:

It provides information about a company’s assets and liabilities: The balance sheet shows what a company owns (its assets) and what it owes (its liabilities). This information is important for understanding how the company is financed and how it generates and uses cash.

It helps to assess a company’s financial stability: The balance sheet provides a snapshot of a company’s financial position and can be used to assess its stability and solvency. A company with strong assets and low liabilities is generally considered to be more financially stable than a company with weak assets and high liabilities.

It can be used to analyze a company’s liquidity: The balance sheet provides information about a company’s ability to pay its short-term debts and obligations. This is known as liquidity. By comparing a company’s current assets (such as cash and accounts receivable) to its current liabilities (such as accounts payable), investors and creditors can get a sense of the company’s liquidity.

It can be used to compare companies: The balance sheet is a standardized financial statement that is prepared in the same way by all companies. This allows investors and creditors to compare the financial positions of different companies and evaluate their relative strengths and weaknesses.

Overall, the balance sheet is an important tool for understanding a company’s financial position and making informed decisions about its financial health.

Who prepared the business's balance sheet?

The balance sheet is prepared by the company’s management, typically with the help of the company’s accounting team. It is based on the company’s financial records and the accounting principles that are followed by the company.

The balance sheet is usually prepared at the end of the company’s fiscal year, although it can also be prepared at other times as needed. Once the balance sheet is prepared, it is reviewed and approved by the company’s board of directors before being made available to the public.

The balance sheet is an important financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows the resources that the company controls, the obligations it has to outsiders, and the residual interest in those assets that belongs to the shareholders. The balance sheet is used by a variety of stakeholders, including investors, creditors, and managers, to evaluate a company’s financial health and make informed decisions.

What is the key difference between a balance sheet and an income statement?

The balance sheet and the income statement are two of the main financial statements that companies use to report their financial performance and position. While both statements provide important information about a company, they are used for different purposes and present different types of information.

Here are some key differences between the balance sheet and the income statement:

Time period:

The balance sheet presents a company’s financial position at a specific point in time, while the income statement presents a company’s financial performance over a specific period of time, such as a year or a quarter.

Type of information:

The balance sheet shows a company’s assets, liabilities, and equity, while the income statement shows a company’s revenues, expenses, and net income (profit or loss).

Purpose:

The balance sheet is used to evaluate a company’s financial position, while the income statement is used to evaluate a company’s financial performance.

Format:

The balance sheet is organized into two main sections: assets and liabilities and equity. The income statement is organized into two main sections: revenues and expenses.

Overall, the balance sheet and the income statement are two important financial statements that provide different types of information about a company’s financial position and performance. They are both used by investors, creditors, and managers to make informed decisions about the company.

How to make balance sheet of the company ?

To create a balance sheet, a company needs to gather and organize its financial information. Here are the steps to follow to create a balance sheet:

Gather financial information: The first step in creating a balance sheet is to gather financial information from the company’s accounting records. This includes information about the company’s assets, liabilities, and equity.

Organize the information:

Once the financial information has been gathered, it needs to be organized into the appropriate categories for the balance sheet. The balance sheet is typically divided into two main sections: assets and liabilities and equity.

Calculate the total assets:

The total assets are the sum of all of the company’s assets. This includes both current assets (such as cash and accounts receivable) and noncurrent assets (such as property, plant, and equipment).

Calculate the total liabilities:

The total liabilities are the sum of all of the company’s liabilities. This includes both current liabilities (such as accounts payable and taxes payable) and noncurrent liabilities (such as long-term debt and leases).

Calculate the equity:

The equity is calculated by subtracting the total liabilities from the total assets. This represents the residual interest in the assets that belongs to the shareholders.

Review and finalize the balance sheet:

Once the assets, liabilities, and equity have been calculated, the balance sheet should be reviewed for accuracy and completeness. Any necessary adjustments should be made before the balance sheet is finalized.

Overall, creating a balance sheet involves gathering and organizing financial information, calculating the total assets, liabilities, and equity, and reviewing and finalizing the balance sheet. Once the balance sheet is complete, it can be used to evaluate a company’s financial position and make informed decisions.

How should financial ratios be analyzed in balance sheets?

Financial ratios are useful tools for analyzing a company’s financial position and performance. There are many different financial ratios that can be calculated from a company’s balance sheet and other financial statements. Here are some steps to follow to analyze financial ratios from a balance sheet:

- Choose the appropriate ratios: There are many different financial ratios that can be calculated from a balance sheet. It is important to choose the ratios that are most relevant to the company’s industry and the specific aspects of its financial position and performance that you want to analyze.

- Gather the necessary information: To calculate financial ratios, you will need certain information from the company’s balance sheet and other financial statements. Make sure you have all of the necessary information before you start calculating the ratios.

- Calculate the ratios: Once you have all of the necessary information, use the appropriate formulas to calculate the financial ratios. There are many resources available online that provide detailed explanations of how to calculate different financial ratios.

- Interpret the results: After calculating the financial ratios, interpret the results to get a better understanding of the company’s financial position and performance. Compare the ratios to the company’s industry benchmarks or to the company’s own ratios from previous periods to see how it is performing.

- Take appropriate action: Based on your analysis of the financial ratios, consider what actions might be appropriate. For example, if you find that the company’s liquidity ratios are lower than desired, you might recommend that the company take steps to improve its liquidity.

Overall, analyzing financial ratios from a balance sheet involves choosing